Antiques, Collectibles, and Cash: The Psychology of Value in the Modern Market

In the current market, antiques and collectibles gain value through a blend of nostalgia, documented provenance, and rarity. Economic uncertainty makes tangible assets appealing as hedges, while social media accelerates trends and expands access. Condition and authenticity, verified by professional guidance, remain essential for price premiums. Regional cultures and shifting tastes further influence demand. Discerning collectors balance short-term fads with items of enduring significance. More about these market dynamics and strategies emerges through a closer look.

Why We Collect What We Do

Across cultures and times, nostalgia has emerged as a powerful psychological driver in the formation of art and antique collections. Nostalgic triggers—often rooted in personal or cultural history—anchor emotional connections to historical artifacts, transforming objects into vessels of memory preservation and identity expression.

Collectors seek items that evoke a “past golden period,” using them to sustain personal narratives and bridge generational divides. As symbols of cultural significance, collections document the evolution of societies and safeguard traditions susceptible to modern amnesia.

Community bonding also arises from shared appreciation of specific periods or styles, reinforcing group identities and creating networks among like-minded individuals. The act of collecting in this setting offers comfort during times of instability, manifesting as a psychological buffer and a means of exerting control over one’s history.

Ultimately, these motivations illuminate why certain works and artifacts gain prominence, shaping market demand and the value ascribed to them.

Tangible Assets in an Uncertain Economy

Periods of economic volatility have historically prompted a renewed interest in tangible assets such as fine art, antiques, and collectibles. As global growth slows and inflationary pressures persist, investors seek alternatives that offer investment stability amid pronounced market fluctuations.

Tangible assets—valued for their physical presence and intrinsic qualities—are perceived as stores of value when paper assets face sharp devaluations or unpredictable movements. During recent economic shocks, however, tangible investments have shown less resilience compared to intangible ones, reflecting their vulnerability to disruptions in physical supply and demand.

Nonetheless, the appeal of tangible assets persists, rooted in their ability to hedge against inflation, currency risk, and financial market unpredictability. Their scarcity, uniqueness, and ease of assessment improve desirability, especially for those seeking diversification.

Tangible assets offer inflation protection, diversification, and enduring appeal through their scarcity, uniqueness, and reliability amid market uncertainty.

While long-term economic shifts favor intangibles, the psychological comfort and perceived permanence of tangible assets remain significant drivers influencing market behavior during uncertain times.

Social Media’s Impact on Vintage and Collectibles Markets

Rarely has a technological shift so thoroughly redefined the vintage and collectibles markets as the rise of social media platforms in the past age.

Online sales of art and antiques have doubled since pre-pandemic levels, with 20% of transactions now occurring digitally by 2022. Social media algorithms now amplify niche interests, quickly connecting motivated buyers with specialized dealers.

Influencer marketing has become central, with content creators demonstrating curation techniques and leveraging high-resolution imagery to build credibility and trust. Features such as Instagram Stories and TikTok’s viral hashtags—#antiquestorefinds, for instance—have democratized expertise, allowing even novice collectors to participate and learn.

Direct messaging has emerged as a primary mechanism for negotiation and sales, bypassing traditional gatekeepers. Price transparency and augmented reality tools further lower barriers, while global marketplaces erase geographic limitations.

This confluence of social media dynamics has fundamentally altered accessibility, aesthetics, and the velocity of value formation in collectible markets.

Storytelling and Provenance: The Power of History

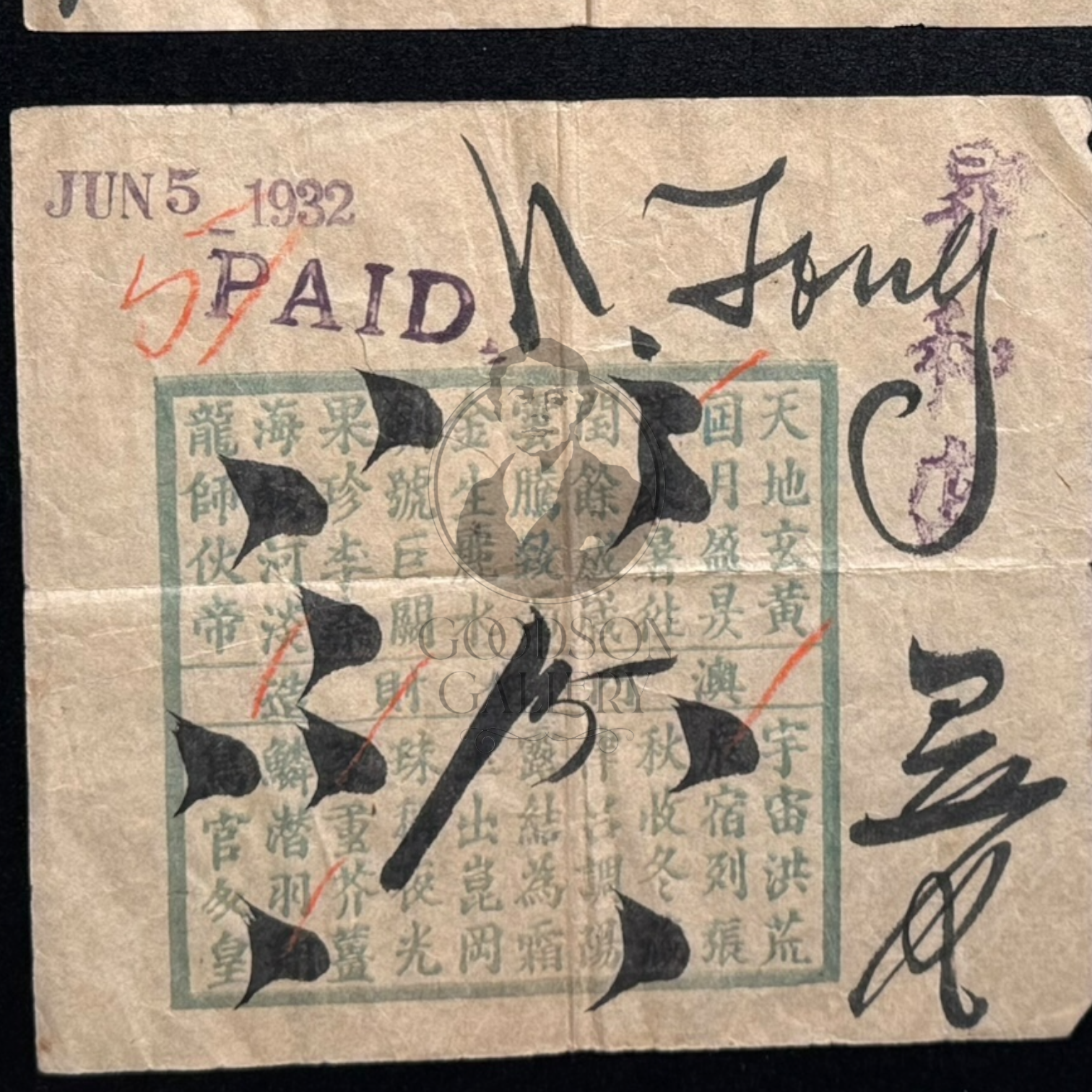

Although the intrinsic qualities of an artwork or antique—such as craftsmanship, rarity, or aesthetic appeal—form the foundation of its value, the documented history of ownership and origin, known as provenance, exerts a profound influence on both desirability and market price.

Provenance serves as an object’s biography, providing concrete evidence of authenticity and reducing the risk of forgery. Documentation—such as certificates of authenticity, original receipts, historic photographs, and mentions in archival records—establishes narrative significance, connecting items to notable individuals or historical events and thereby heightening collector interest.

This narrative fosters an emotional connection, transforming an object from a mere commodity into a vessel of personal and cultural memory. For collectors and institutions, strong provenance increases buyer confidence and can substantially raise an item’s market value.

Conversely, the absence of clear provenance can diminish worth and trust, highlighting the necessity of rigorous research and expert validation within the market.

Sustainability and the Vintage Revival

How has sustainability reframed the value of vintage goods in the modern market? The resurgence of vintage sustainability is rooted in growing environmental concerns and a critical reassessment of consumption patterns.

Vintage fashion and decor, by reducing demand for new production, directly lower carbon emissions and material waste. Eco friendly fashion now extends beyond aesthetics, as consumers—particularly Generation Z—prioritize purchases that align with sustainability and ethical values.

Choosing vintage fashion and decor lowers carbon emissions, reduces waste, and reflects the growing demand for truly sustainable, value-driven purchases.

Vintage items, known for superior craftsmanship and durability, offer long-lasting alternatives to fast fashion and disposable decor. Upcycling further supports this trend, as designers repurpose vintage garments to create unique, resource-efficient pieces that resist obsolescence.

The circular economy benefits as antique and vintage goods are reused, extending their life cycles and preventing landfill overflow. These market shifts underscore a broader movement: vintage consumption as both a personal statement and a strategic step toward reducing the environmental impact of modern lifestyles.

The Allure of Status: Recognizable Brands and Their Premium

Status has long been entwined with the visual language of recognizable brands, whose logos and signature designs serve as immediate markers of wealth and exclusivity. Brand recognition operates as a powerful tool in status signaling, allowing individuals to communicate social standing through luxury symbolism without explicit explanation.

Historically, luxury brands have utilized such visibility to command premium pricing, their exclusivity appeal reinforcing established social hierarchies. Consumer psychology reveals that the emotional value embedded in owning branded items extends beyond utility, providing intangible benefits such as pride and in-group belonging.

These motivations underpin strong brand loyalty and justify the willingness to pay significant premiums. Market dynamics reflect this, as recognizable brands demonstrate greater price elasticity and robust resale markets, with provenance and branding history amplifying collectible appeal.

The interplay of social signaling and economic value sustains the market for premium brands, cementing their role as enduring instruments of distinction and cultural currency.

Regional Trends Shaping Collectible Demand

Distinct regional dynamics underpin the evolving landscape of the global collectibles market, shaping both the types of items in demand and the mechanisms through which they are traded.

In North America, regional influences such as strong disposable incomes and a deep-rooted pop culture tradition drive demand for sports memorabilia, trading cards, and retro toys, reinforced by platforms integrating grading and authentication.

In contrast, Asia Pacific’s rapid growth is propelled by economic expansion and urbanization, with collectors seeking both traditional artifacts of cultural significance and contemporary items linked to anime, K-pop, and gaming.

Europe’s market reflects historical depth, where antiques, fine art, and regional artisan crafts are favored, supported by mature auction houses and established networks.

Latin America, particularly Brazil, exhibits growing interest anchored in national identity, with soccer memorabilia and local art gaining prominence.

Across regions, online marketplaces improve accessibility, but the specific blend of collectible demand remains closely tied to regional influences and cultural significance.

Diversifying Your Portfolio With Antiques and Collectibles

Portfolio diversification has long been a cornerstone of prudent investment strategy, and the inclusion of antiques and collectibles offers a compelling extension beyond traditional asset classes.

Historically, collectibles such as fine art, rare automobiles, and fine wine exhibit low correlation with equity markets, providing a potential hedge against financial volatility. As investment strategies evolve, ultra-high net worth individuals now allocate approximately 6% of their portfolios to such tangible assets, seeking both financial returns and a measure of portfolio balance.

Alternative investment platforms and fractional ownership models have further democratized access, allowing broader participation with reduced capital risk. Nevertheless, the market’s reliance on subjective tastes presents unique challenges, and the risk of illiquidity is notable if overexposed.

Professional guidance in collection structuring and asset selection is increasingly available, reflecting the sector’s maturation. When properly integrated, antiques and collectibles can improve portfolio balance, offering diversification benefits during periods of economic uncertainty.

Condition, Authenticity, and the Price Premium

While the allure of antiques often lies in their history and rarity, it is the interplay of condition and authenticity that most directly shapes market value and price premiums.

Condition assessment, involving scrutiny of an object’s physical state, restoration needs, and presence of original parts, is fundamental. Pristine items generally command higher prices, though genuine wear or historical usage can occasionally improve value by reinforcing provenance. Authentic conservation methods are favored, as improper restoration may compromise both value and historical integrity.

Authenticity verification is similarly essential; provenance documentation, maker’s marks, and historical records provide critical evidence of origin and period. Comparative analysis with established databases and expert appraisals further substantiate claims, often resulting in significant price premiums, especially when rarity and craftsmanship are evident.

Ultimately, items that excel in both condition assessment and authenticity verification are best positioned to achieve raised market valuations, particularly in competitive auction environments where demand is high.

Tracking Trends: Short-Term Fads vs. Long-Term Value

How do collectors and investors distinguish between fleeting enthusiasm and enduring value in the art and antiques market?

Fads analysis begins with recognizing the hallmarks of short-term trends: surges in demand often fueled by social media, nostalgia, or seasonal decor preferences. Items such as cottagecore kitchenware or sports cards frequently experience rapid appreciation, yet their value assessment reveals limited durability due to overabundance, lack of rarity, and dependence on current tastes.

In contrast, long-term value rests on factors like historical significance, rarity, provenance, and craftsmanship. Examples such as 19th-century quilts or gold bars demonstrate that items with documented origins, consistent collector demand, and inherent scarcity tend to resist volatility and preserve wealth across generations.

Investors, as advised by firms like Goodson Gallery, mitigate trend risk by diversifying portfolios, weighing both immediate popularity and foundational attributes during value assessment—ensuring decisions reflect both current market conditions and established, evidence-based benchmarks for lasting worth.

Conclusion

The antiques and collectibles market today is driven by a mix of nostalgia, financial strategy, and shifting cultural trends. Smart buyers and sellers consider not just authenticity, history, and the stories behind items, but also condition and market forces. With branding and social media influencers changing how we determine value, successful players in this space need both emotional intelligence and analytical skills. This changing landscape shows how our perception of what things are worth keeps evolving—making antiques and collectibles valuable both as cultural touchstones and as financial investments.